Beyond the Paycheck: How to Pick the Best Job for You

How a simple exit interview revelation impacted our entire internship program

Sometimes the most important lessons come disguised as casual conversations. Last fall, I asked every intern, “What do you know about benefits?” The silence was deafening. Thirty-plus bright, talented students, and none of them knew anything about benefits. The only exception? Our HR intern.

That’s when it clicked. These smart kids, about to enter the job market, will be making decisions based on incomplete information. They’ll be choosing between offers without understanding a significant piece of the compensation puzzle.

I started thinking about my own post-graduation job hunt. The memories came flooding back: scanning offer letters for the salary number, maybe glancing at the other benefits.

Healthcare? Check, everyone offers healthcare. 401k? Check, that’s standard. What is really left to differentiate between job offers? SALARY! I had a classic case of tunnel vision.

If I could travel back in time and have a conversation with my younger self, I’d explain what I was actually giving up by not asking the right questions. That tunnel vision definitely cost me – not just in dollars, but in missed opportunities to improve my overall compensation.

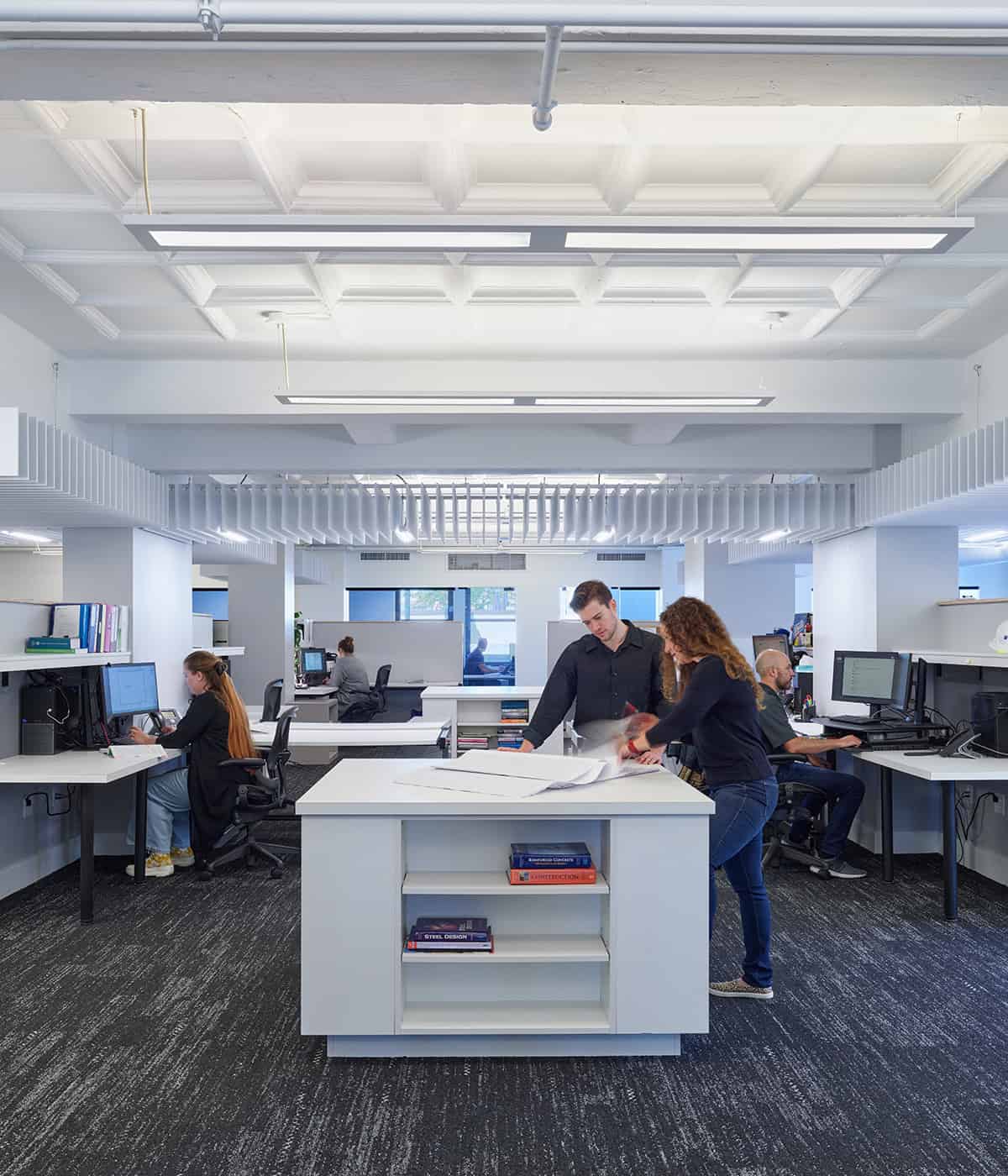

That’s when I knew: year three of our internship program needed to be different. We scaled back from 32 to 20 interns across six offices, but we added something revolutionary: actual benefits education. Creating space for something I was genuinely excited about – something I wished someone had taught me when I was making my first career moves.

We were going to teach them how to see the whole picture.

The Seminar That Ran Long (And Nobody Minded)

We started with healthcare. Enter, Sandy Blankenship, our benefits specialist. I was nervous she’d lose them in five minutes with insurance jargon and acronym soup. Instead, something magical happened: Hands shot up, more questions were asked and the room came alive.

The seminar ran over time! Not because Sandy was long-winded, but because these interns were hungry for knowledge nobody had ever offered them before.

Here’s what surprised them: We don’t offer healthcare because we have to. We offer five medical plans because people’s lives look different – kids, no kids, tight budgets, bigger safety nets. It’s a simple idea, rooted in real care. Choice isn’t a perk here – it’s how leadership shows value for their employees.

But what really got their attention? Our HSA option. Wallace contributes a set amount to your healthcare benefits. Pick the lower-cost HSA plan, and the leftover goes straight into your health savings account. Now you’re not just getting insurance – your employer is funding a tax-advantaged savings account that doubles as a retirement vehicle for medical, dental and vision expenses – for you and your tax dependents.

I watched as twenty light bulbs flickered on simultaneously.

More Than Money Management

But we didn’t stop there. Trey Eagleton from Eagleton Financial Group came in to talk real money strategy. Free financial advising is another perk Wallace offers to its employees. This isn’t just about explaining our 401k – it’s about giving these future professionals the tools to win financially from day one.

Student loan optimization. House down payment strategies. Investment planning both inside and outside company plans. Even 529 college savings for kids they don’t even have yet. The engagement was incredible.

Here’s what I’ve learned: I love working at Wallace, but I plan to retire as soon as I’m financially able. This benefit is crucial to keeping me on track, and now our interns have that same advantage from the very beginning of their careers.

The Professional Edge

Next, we discussed how licensure support accelerates careers. Wallace maintains multiple seats with a professional license exam study course. The pass rates? Exceptional. The cost? Covered. No strings attached, no payback requirements. Just Wallace investing in your professional future.

There’s something special about passing your last professional exam ever. And those who come to work for us have the opportunity to get there faster and with less financial stress.

The Salary Trap (And How to Avoid It)

Now let’s talk about the focus on salary I mentioned earlier. Like all firms, Wallace pays technical professionals a salary based on a 40-hour work week. These roles are classified as “exempt employees,” which means they’re not legally entitled to overtime pay

We all know that there will be times when we need to work more than 40 hours a week to get a task done. Wallace believes in rewarding great work and the effort it takes to execute it. Here, salaried professionals receive a discretionary quarterly bonus in recognition of those efforts. Exempt employees can also choose to convert additional hours to paid time off (more on that below).

Compare that to other offers where your “competitive salary” covers however many hours it takes to complete the job. Fifty hours? Same pay. Sixty hours? Still the same pay. So when you’re comparing offers, make sure you’re comparing apples to apples. That “lower” salary might actually be higher when you factor in additional compensation.

The PTO Paradise

I saved the best for last because…who doesn’t love time off?

Our Paid Time Off system is beautifully simple: one pool for everything. Sick days, vacation, mental health days, unexpected emergencies and appointments, whatever the need – the reason isn’t the focus. Time away from the office is necessary, and we get that.

At Wallace, PTO is accrued monthly and here’s the kicker: we’re not on a “use it or lose it” system where employees lose unused PTO at the end of the year. Any unused PTO hours will rollover to the following year. There are limits on how much PTO can be accrued, but even then you don’t lose it. Hours exceeding those limits are paid out to the employee. Prefer flexibility? You can also cash out accrued PTO at your discretion instead of banking more hours – or, my preferred method, you take that dream vacation.

It’s the most flexible system I’ve ever seen.

The Real Test

During exit interviews this year, I asked our interns: “How valuable were the sessions on benefits?” The response was overwhelmingly positive. But more importantly, they left armed with the tools to evaluate future offers.

My favorite question we armed them with: “What was the last benefit you changed based on employee feedback?”

This question cuts straight to the heart of company culture. Does leadership listen? Do they act on input? Are employees partners or just resources?

Look, I love Wallace, but my goal with covering benefits wasn’t just for recruiting. It was to create more informed professionals entering our industry. Whether they join Wallace or not, we want them to make informed decisions about their futures. Total compensation is so much more than salary, and now they know how to evaluate it properly.

Ready to Join the Collective?

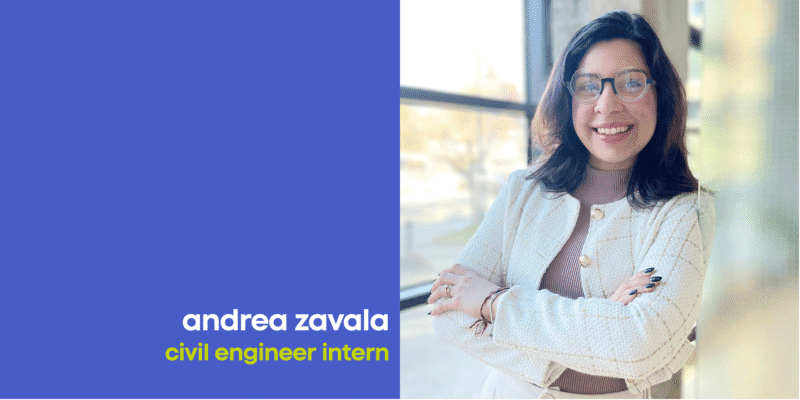

Wallace Design Collective doesn’t just value the insight and experience our interns bring – we’re committed to sending them into the world better prepared than when they arrived. Our curriculum covers everything from technical skills to industry experience and real-world financial literacy.

It’s never too early to start thinking about internship opportunities! Are you a student interested in getting real-world experience in the AEC industry? Reach out for more information – we only have a few spots left!